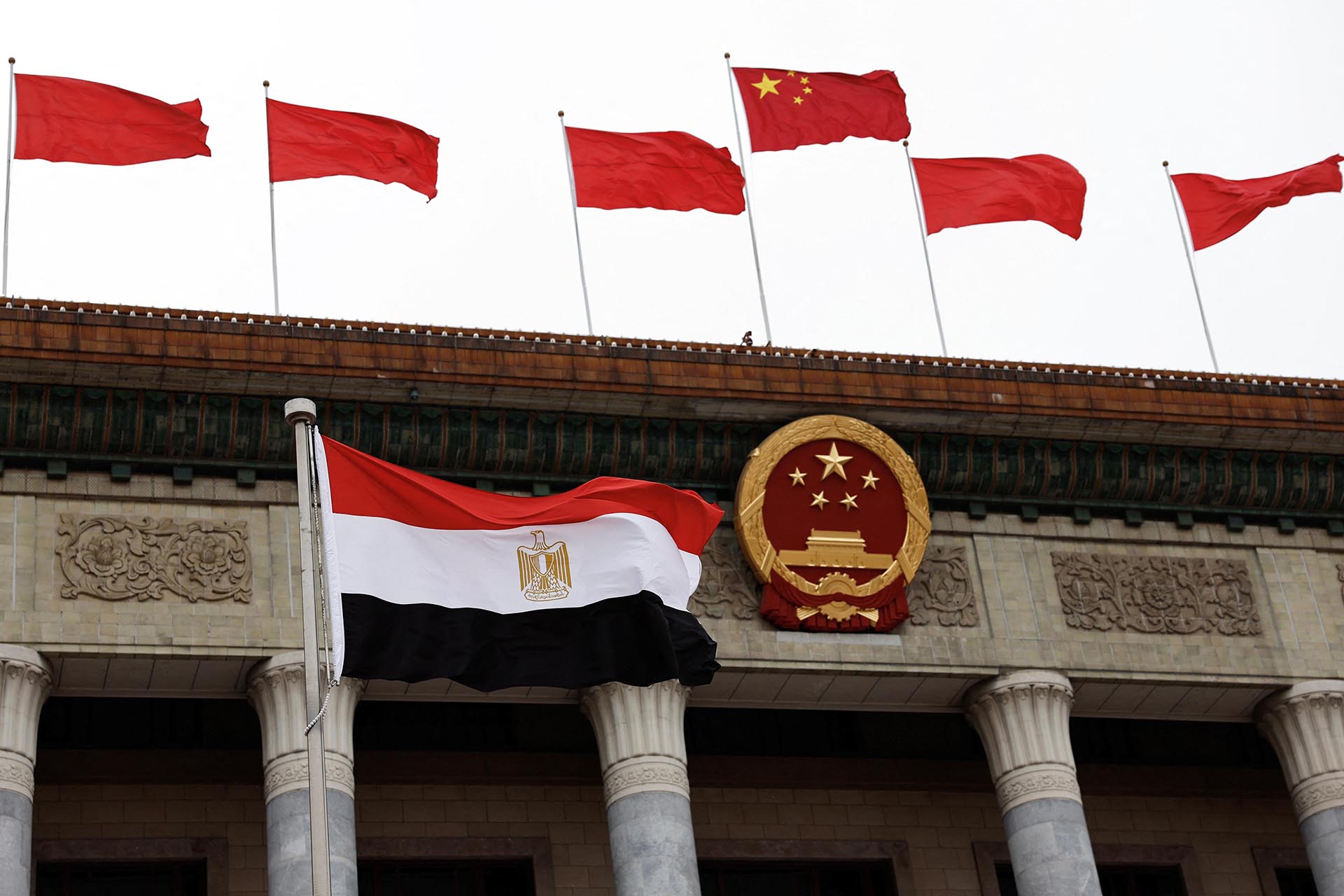

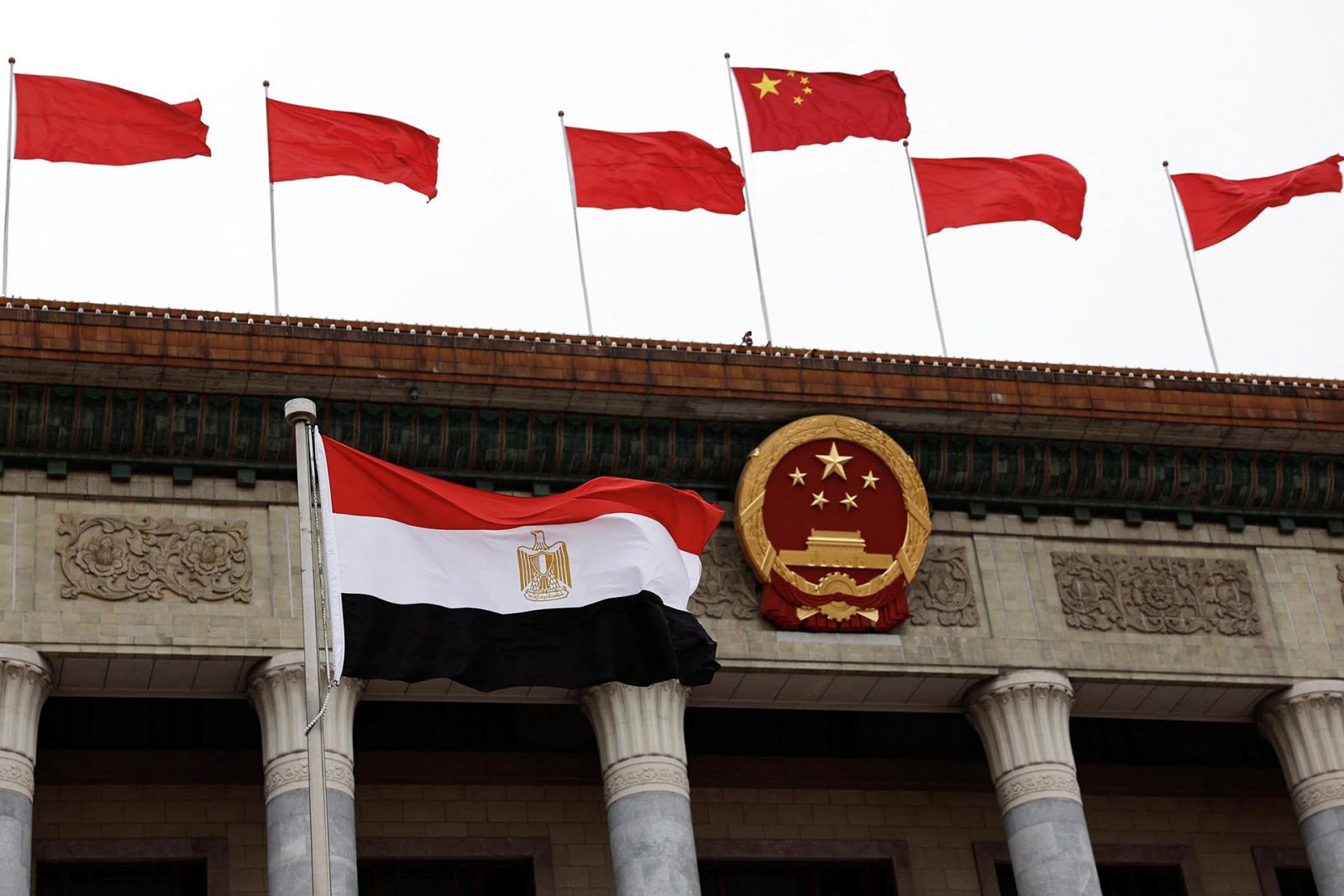

Chinese companies are looking at Egypt amid US trade tension

China Eyes Egypt as Export Hub Amid US Trade Tensions, Boosting Manufacturing Investment

Chinese companies are showing increased interest in relocating production to Egypt, particularly within the Suez Canal Economic Zone (SCZone), as they seek to maintain access to global markets amidst rising trade tensions with the United States. Mostafa Ibrahim, deputy head of the China committee in the Egyptian Businessmen’s Association, told Al Arabiya that Chinese companies are expected to invest between USD 2-3 billion in this relocation effort.

According to Ibrahim, approximately 20-30 Chinese companies are considering expanding into the Egyptian market this year. These companies primarily focus on export-oriented industries such as ready-made garments, textiles, home appliances, and technology.

Nearly two-thirds of the anticipated investments are expected to be directed towards areas near Suez, while the remaining third will be allocated to inland industrial zones.

This surge in interest follows the recent decision by US President Donald Trump to double tariffs on Chinese imports to 20%, which went into effect yesterday. Chinese companies are strategically expanding their manufacturing footprint in Egypt to leverage its free trade agreements with the US and Europe. This allows them to potentially bypass tariffs and maintain their export flows to these key markets. Additionally, Egypt's competitive labor costs and substantial consumer market are significant factors driving this expansion.

Pharmaceutical Sales in Egypt Show Strong Growth in 2025

In other economic news, the Egyptian pharmaceutical sector is experiencing robust growth. Data from Souq Al Dawaa, citing industry insiders, indicates that pharmaceutical sales increased by 54.7% year-on-year in value during the first month of 2025, reaching EGP 21.5 billion. Sales volume saw a more modest increase of 6.5% year-on-year.

The sector concluded 2024 with strong performance, recording a 42% year-on-year increase in sales value, despite a 3% year-on-year decline in sales volume attributed to the foreign exchange crisis affecting production lines. The significant increase in sales value occurred in the second half of the year, following the Egyptian Drug Authority's approval of several price hikes. These adjustments were made in response to demands from local pharmaceutical companies that prices should reflect the new foreign exchange rates following the Egyptian pound's float in March.

EgyptInnovate site is not responsible for the content of the comments