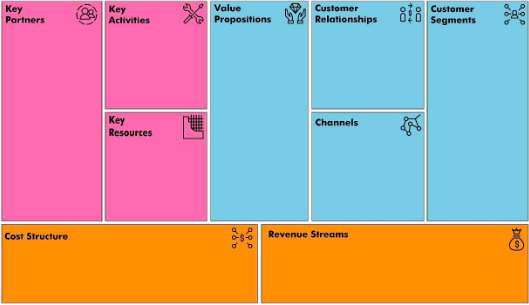

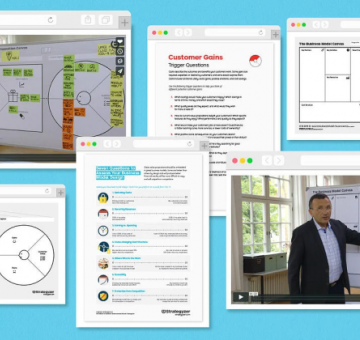

Everything you want to know about The Business canvas model

We discussed previously how to take a decision of whether you should invest in a bank account or in a startup, in this article we will give you more information to consider in case of investing in a startup.

If you decide to invest in a startup, you should consider the following:

- Reading the business model

- Financial planning

- Follow up and expansion plan

Business Model

The best classification I use to arrange my thoughts while reading a business model are 3 main ones

- Basic information of the project

- Key activities

- Key partners

- Key resources

2. Market positioning

- Value propositions

- Customer relationships

- Customer segments

- Channels

3. Financials

- Cost structure

- Revenue streams

Let’s walk through each item:

1. Basic information of the project

Key partners: partners/stakeholders of a business are the direct and indirect entities that affect the operations of a business, in other words all the parties involved in the operational logistics. Partnerships and protocols and even verbal connections and communications are very important to any business.

For example, suppliers could sell raw materials on credit bases for you where you can pay back after certain time usually after the selling of the product which might be a solution for liquidity obstacle, or partnering with a high tech packaging factory when you don’t have the resources to purchase a high quality packaging machine.

You may have orders higher than your capacity, so you cooperate with other factories to work on it together or vice versa when you don’t have orders at the beginning of the business and you take undercover orders from other businesses. In short, key partners always work on a win-win situation to keep you and others in business.

Key activities: all the activities that the business does to operate and sell such as purchasing, production, marketing, selling, and after sale services matter and affect the profits of the project

Key resources: all the factors helping you operate the business either physical such as equipment, human resources, financial such as all monetary funds available to operate and intangible resources such as a franchise that you lease for others to operate under your name

2. Marketing positioning:

Key propositions: the main tip of this element is knowing your customer’s needs and the market gap and fill this with a product of value that matches this need and gap at a reasonable price.

What is a value that the product could add to: functional, emotional, symbolic, economic and end value

Customer relationships: Customer relations is a journey starting from targeting the client till you sustain loyalty of the client through a long term vision. During the early stage, targeting the right customers is the key of your relationship with the customers. Customer relationship doesn’t end the moment you sell your product, it continuous for feedback and after sale services.

Customer segments: knowing your customers and who will purchase your product is a key success element, this will consequently affect the marketing strategies, the pricing, the packaging of your product.

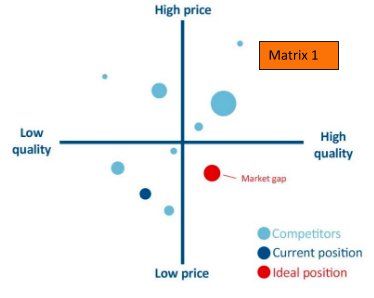

for simplification we use the following matrix 1 to draw a market croquet.

You need to ask yourself the following questions: what am I selling? what is the % of its quality in regards of raw materials, finish, packaging. etc.? , who would be interested to buy this product ?

Channels: Channels allow the product to reach your customers, to link channels to our previous marketing elements it links the value proposition to customer segment. A project could lead a B2B channel method which is the project as a business sells to another business who sells it to final client in the market after that this could be selling to a retailer, another factory, etc. or a B2C channel method which is selling to the final customer in the market directly

3. Financials

Cost structure: All the expenses/costs/price that the business need to operate. Cost in its simple division is diversified into fixed costs and variable costs.

| Variable Costs | Fixed Costs |

|

costs that differ based on the production size. Examples:

|

All costs that would be paid either the business is operating and gaining profit or not Examples:

|

Cost structure appears as an overall lump sum when being tracked, however It is wise to segregate the cost types into simpler groups called cost pool, and allocate a percentage to each pool of expenses, for example: Cost related to overhead, cost related to employees, cost related to raw materials ... Etc. Reallocation of the costs should be based on the initial grouping

Revenue streams: all sources of income to the business such as income generated from sales, income generated from brokerage, income generated from rentals, income generated from franchise, revenues are not profit. Revenue increase with the increase of the operations size and capacity, having an increasing revenue streams over 6 months is an indication of a healthy business

General rule is that Cost and revenue should be monitored and compared, corrective actions and expansion plans are built based on the results of this comparison, I suggest to develop a simple T balance for the cost vs revenues

| Cost | Revenue |

|

You should write down the full description and duration adding the value of money |

You should write the full description of the activity that resulted in such revenue The T balance should always be positive, otherwise the business is not moving in the right direction |

Numerical example:

| Cost | Revenue | ||

|---|---|---|---|

| Amount | Description | Amount | Description |

|

3000 EGP

|

Raw materials | 6000 EGP | Cash Sales |

| 500 EGP | Transportation | ||

| 1500 EGP | Rent | ||

|

5000 EGP |

Total | 6000 EGP | Total |

| 1000 EGP | Balance |

Photo credit: mindmandi

EgyptInnovate site is not responsible for the content of the comments