Should you Invest in a Startup or in a Bank Account?

If you are considering running or investing in a startup, then it is necessarily accompanied by risks and many decisions, you must be a wise risk-taker, which means you need to calculate the risk and its impact on your life.

If we were to have a magic wand to see the future, we would definitely see risk takers in a completely better place.

Let’s decide which way is best to utilize your money, is it by opening a saving bank account or investing in a startup?

One of the most important aspects of this decision is the financial one. It is wise to start by brainstorming so that you would be able to set a specific goal then, you can think about how to reach it, along with setting time intervals and milestones. Give yourself a chance to evaluate and revisit your goals, build corrective actions and/or expand.

To make a financial decision, we need to focus on several points; how much money would I invest in both situations? What is the return of each choice, duration of this return, and impact on my overall financial management? So how can we do this? We need to analyze both scenarios bank investment VS a startup investment.

Bank investments:

Scan the banks’ different interest rates available and choose the best rate with taking into consideration the return on investment amount annually, here are some examples of the current market in case of investing in a fixed saving certificate:

Bank name CIB Cairo bank

Interest rate 14% 13%

Startup:

To be able to take a decision taking into consideration the startup’s potential success, we need to analyze the business model of the potential project that you want to invest in.

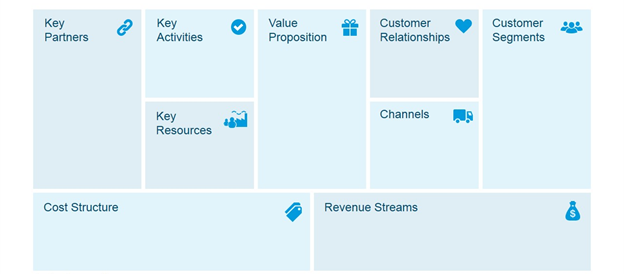

A business model is a template that makes you understand how your business earns money starting from what are the key activities of the project, its value, the target customers segment, how to manage their relations, moving to cost structure, how to generate revenue, and what is the profit margin.

Every investor needs to know about different types of business models, here are four basic archetypes of a business model

• Manufacturer/creator

• Broker

• Trader/distributor

• Landlord/lesser

Business model canvas

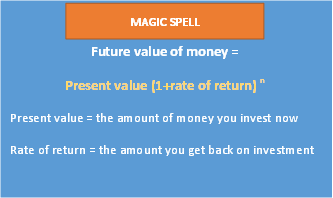

Now how can I compare and make an investment decision? Below is a magic spell equation that can help you compare both methods of money utilization, opening a saving bank account or launching a startup.

Magic Spell

Sometimes the rate of return is different from one year to another, especially in startups, so to mitigate this take an average of the expected returns and use it in your calculations.

Let’s apply the previous equation into a practice example for both scenarios.

Scenario 1: If I invested 100K EGP to open a saving bank account of a complex interest rate of 15% annually, we apply the equation as follows:

Divide the 15% into quarters, so 15%/4 =3.75 % complex rate and this makes our “n”= 4 quarter

Future value = 100K (1+ 0.0375) 4 = 115,865 EGP.

Scenario 2: if I invested 100k to open a startup account of return of 20% annually

First step we need to divide the 20% into quarters so 20%/4 =5% complex rate and this makes our “n”= 4 quarter

Future value = 100K (1+ 0.05) 4 = EGP 121,550.

When making a financial decision, we need to take in consideration all options and do a lot of calculations, our mission is to walk you through this interesting journey and smoothly plant the risk taker in you. Stay tuned for future articles that will explain other factors to take into consideration.

EgyptInnovate site is not responsible for the content of the comments